How I Would Get Into Real Estate Today (if i could start over)

How I Would Get Into Real Estate Today (if i could start over)

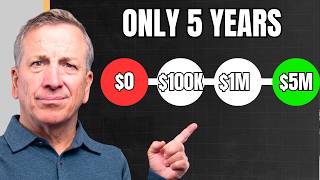

Ken McElroy shares his exact step-by-step strategy for rebuilding a real estate empire if he had to start from scratch today. This video outlines the key moves that will fast-track you to success in real estate investing.

Ken McElroy shares his exact step-by-step strategy for rebuilding a real estate empire if he had to start from scratch today. This video outlines the key moves that will fast-track you to success in real estate investing.

Ken has a real estate strategies podcast! Follow your favorite platform each week.

Apple Podcasts: https://apple.co/3jDqftx

Spotify: https://spoti.fi/31GUDwW

Follow Ken on social media at: https://x.com/kenmcelroy

• • •

Be sure to click the bell to be notified as soon as the next informational video is posted!

Visit Ken’s Bookstore: https://kenmcelroy.com/books/

•

ABOUT KEN:

Ken is the author of the bestselling books The ABC’s of Real Estate Investing, The Advanced Guide to Real Estate Investing, The ABC’s of Property Management, and has an upcoming book: “ABCs of Buying Rental Property: How You Can Achieve Financial Freedom in Five Years.” Ken is a Rich Dad Advisor.

Ken offers a wealth of personal experiences, practical advice, success stories, and even some informative setbacks, all presented here to educate and inspire. Whether you’re a new or seasoned investor, the information and resources on this channel will set you on a path where you and your investments can thrive.

Ken’s company: https://mccompanies.com/

•

DISCLAIMERS: Any information or advice available on this channel is intended for educational and general guidance only. Ken McElroy and KenMcElroy.com, LLC shall not be liable for any direct, incidental, consequential, indirect, or punitive damages arising out of access to or use of any of the content available on this channel. Consult a financial advisor or other wealth management professional before you make investments of any kind.

Although Ken McElroy and his affiliates take all reasonable care to ensure that the contents of this channel are accurate and up-to-date, all information contained on it is provided ‘as is.’

Ken McElroy makes no warranties or representations of any kind concerning the accuracy or suitability of the information contained on this channel.

Any links to other websites are provided only as a convenience and KenMcElroy.com, LLC encourages you to read the privacy statements of any third-party websites.

All comments will be reviewed by the KenMcElroy.com staff and may be deleted if deemed inappropriate. Comments which are off-topic, offensive or promotional will not be posted. The comments/posts are from members of the public and do not necessarily reflect the views of Ken McElroy and his affiliates.

2024 KenMcElroy.com, LLC. All Rights Reserved.

#kenmcelroy #realestate #realestateinvesting #realestate #realestateinvesting #realestatelicense #propertymanagement #buildingwealth #passiveincome #investmentstrategy #realestateeducation #commercialrealestate #residentialrealestate #propertymanager #realestatebusiness #realestateempire #realestatenetwork #financialfreedom #realestatetips #realestatedevelopment #apartmentinvesting #buyingproperty #realestatedeals #wealthbuilding #rentalproperty #realestatemarket #passiveinvesting #syndication #realestatestrategy

I have $70K in savings but haven’t invested much before. Retirement is a big concern for me. At 55, what are the best ways to grow my money for retirement?

this was my dream since 1976 and I started to study with such passion. It would have been amazing but life, health for 4 decades would not allow it to happen no matter how hard I worked, how hard I studied, no matter how hard I tried. Now I’m in my late 60s and struggling financially and know this wonderful dream will never happen for me but I will continue to watch this and fantasize about this and what could have been if life had not been so cruel. I truly hope this dream life comes true for everyone else out there who has the passion like I did. God bless all of you, especially Ken McElroy for helping us.

I feel like this focuses mostly on multifamily but what if you wanted to do the single family approach?

Ken, thank you for the video. Does your company offer real estate courses?

Ken it was privilege to meet you and learn from you. Your wisdom is priceless…

In the early 1990s, when I purchased my first residence in Miami, mortgage rates were commonly in the 8-10% range. Today’s market participants must recognize that the historically low rates of 3% may not return. If sellers are compelled to list their properties, market dynamics will likely drive prices downward, leading to reduced valuations—this is a sentiment that many in the industry share.

Love the info. Keep up the good work

thank you for sharing this information

4ra’s bet recalculations never disappoint, transparency and speed 🕒

Thanks for sharing.

If you appreciate the effort Ken puts into the videos and want to support the channel, please share this video.

thank you

I’m more into cricket betting right now they have this new match bonus that got me some extra cash 🏏

The way 4RA displays stats and info, makes deciding bets so much easier 📊

4ra events shine even brighter with Aaron Finch around he’s a real indicator of reliability

Thank goodness you brought this up! Truly, investing has changed my perspective on how one can succeed in life; working multiple jobs isn’t the optimal way to attain financial freedom and unfortunately, we discover this later in life. Currently earn as much as 10 grand weekly and this has improved my financial life. Great piece!

Love how this breaks down the REAL roadmap to success in real estate!

Having Aaron Finch at 4ra events brings a spark of trust and high-caliber sportsmanship

The real estate market is always a hot topic, especially with the growing demand for new real estate developments. Even something as basic as buying an apartment in a good location could be very profitable. Based on the estimated sales price, the outstanding mortgage balance, and property taxes and expenses, this is the estimated amount you’ll get when you sell your home. Investments are the foundation of financial security; the deeper they are, the more solid your future will be.

This! I am subscribed now.

Just own it you dont need no license

Amazing video, A friend of mine referred me to a financial adviser sometime ago and we got talking about investment and money. I started investing with $120k and in the first 2 months , my portfolio was reading $274,800. Crazy right!, I decided to reinvest my profit and gets more interesting. For over a year we have been working together making consistent profit just bought my second home 2 weeks ago and care for my family…

This is such an insightful and practical strategy for rebuilding a real estate business from scratch. I love how you break down the process into actionable steps, starting with gaining essential knowledge through a real estate license, which lays the foundation for success. Picking a lane and becoming an expert in it is crucial, as it builds confidence and establishes your reputation in the industry.

More immediately than a collapse in the stock or real estate markets, inflation directly impacts people’s standard of life. It is hardly surprising that the present market attitude is so negative. If we are to live in this economy, we are in dire need of assistance. ETF and stock markets are still unpredictably volatile, just like the housing market. My $350,000 portfolio has been reduced to rubble.

Smoothest CTA in the youtube game, I tell my clients to study your videos for how to properly do the video suggestion at the end of each video

A little advice for realtors. If you price the houses realistically you might be able to keep your jobs. If you want to keep being cute then we’ll find out how long you can go without a paycheck.

Great information!

I’ve been watching the housing market closely, Prices have been skyrocketing for years. It’s going to be tough for first-time buyers to enter the market." how can one diversify $280k reserve .

Great video, one that folks really need to watch. I could have made a fortune as a day trader shorting almost every stock ‘ve bought. I have an uncanny ability to buy stocks at the highest price they will sell for months at a time. Thanks for the insight.

Aaron Finch boosting 4rabet events with his presence means you’re in for top-notch quality every time

Vikram Krishna Estates

Following some tips from my brother turned into a decent win last month. Ever had a win that felt extra sweet because it came from a tip

I dont quite understand how the math works, maybe somebody can help? So if I buy a piece of land and build a fourplex on it lets say for a total of 1 mio CAD. and I get 7200$CAD/month for the rent. My yearly mortgage would be 71,510.28$ (25 years at 5.25%). My yearly rental income would be 64,800 (86,400 times 75% because 25% is expenses such as property tax, insurance, repairs, etc.). There is no room there to run for positive cash flow. I calculated it with some other projects and the best I came up with is maybe breaking even at the end of the month. There is no positive cashflow.

Asking a real estate agent whether you should buy a home right now is like to asking an alcoholic whether they think you should have a drink lol. Homes in my neighborhood that cost around $450k in sales in 2019 are now going for $800 to $950k. Every seller in my neighborhood is currently making a $350k profit. Simply unreal. In all honesty, deflation is what we require. The only other option is for many people to go bankrupt, which would also be bad for the economy. That is the only way to return to normal.

My friend suggested trying the crash games for a quick thrill, and wow, were they right! Have you taken a shot at those yet

Great that this video does NOT have that very distracting background ticking / rapper style music.

I can’t think of too many things that banks will loan money on, but they will loan on real estate. Most banks will not loan on a stock portfolio unless it’s pretty big. So, I can borrow against my property tax-free and buy another property, or stocks, or simply live on the equity. That’s freedom.

Gotta appreciate how 4RBT handles recalculations, always fair and quick ⚖️

You will have to manage a tremendous number of homes to make a living. Property Managment has a significant amount of liability and you need training and you need to know what you’re doing with fair housing laws, etc. It is not for amateurs. You are better off working for an experienced Property Manager as a new agent to learn the trade.

Thanks for sharing, this gave me muck knowledge!

I am 19 years old and im looking to start now so I can retire early

Hello!! how do you guys make huge money monthly, I’m a born Christian and sometimes I feel so down of myself because of low finance but I still believe God

Getting a real estate brokers license is not easy in most states. Plus, the competition is brutal.

This video is spot on! Books like The Secret Doctrine of Wealth offer more value than years of college. It’s all about self-education.

There’s a striking disparity in the real estate sector between salary growth, which has seen a modest 23.6% rise over two decades, and the significant increase in housing prices. This gap is further complicated by other market elements such as low interest rates and a housing supply deficit. Given this volatility, diversifying your investments into sectors like stocks and cryptocurrencies is a strategic move. Notably, these markets offer a broad range of potentially high-yield investment options. Personally, my investment portfolio has flourished under the expert guidance of Dorcia Walston, yielding over $190k in just nine weeks. In these uncertain times, remember the old adage: fortune indeed favors the bold!

Following some tips from my brother turned into a decent win last month. Ever had a win that felt extra sweet because it came from a tip

I Hit $32,590 today. Thank you for all the knowledge and nuggets you had thrown my way over the last week. i started with 5k in last week

2025… now i just hit $32,590

Great content

Why would you buy a home when you’ll never truly own it. You’ll get taxed all the way through on the money you make to pay the mortgage, property and maintenance.

Algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm algorithm

My brother kept raving about 4RABET, so I had to see what the fuss was about. Ever join a platform because of family hype